OpenAI’s new “Frontier” platform isn’t just another product launch. It’s a declaration of war on the entire SaaS industry. And Salesforce is ground zero.

On February 5th, 2026, OpenAI made its most aggressive move into the corporate world yet.

They didn’t just launch a new model. They didn’t just announce a partnership. They unveiled Frontier — an end-to-end enterprise platform designed to build, deploy, and manage AI agents that can run your existing software.

Think about that for a second.

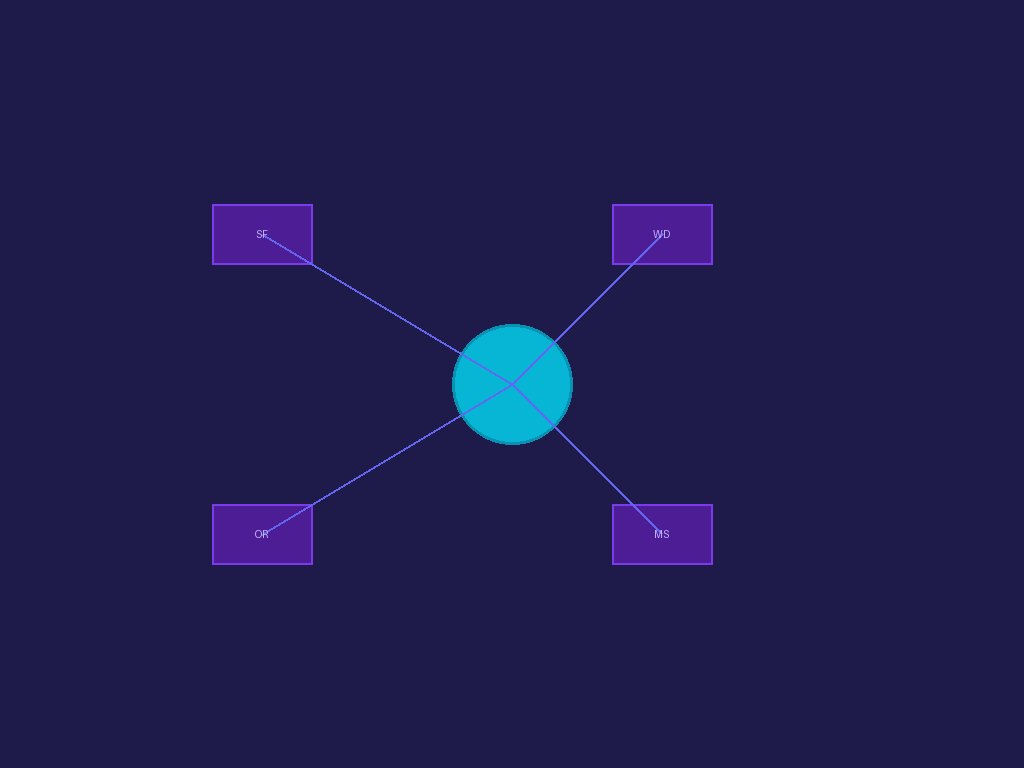

Frontier doesn’t just integrate with Salesforce, Workday, Oracle, or SAP. It orchestrates them. It sits on top of your entire tech stack, directing traffic, executing workflows, and making decisions across systems without human intervention.

Fidji Simo, CEO of Applications at OpenAI, said she had “dreamed of one platform to create and manage all of an organization’s AI tools.”

Well, the dream is here. And it’s a nightmare for incumbent SaaS vendors.

The “Capability Overhang” Problem

Sam Altman framed the launch perfectly at the Cisco AI Summit on February 3rd:

“Businesses increasingly want something like an AI cloud subscription… to partner with an AI company. [They want someone to] handle security and context, linking and access [and] run lots of agents on… a general purpose platform.”

Translation: Enterprises are tired of buying point solutions. They don’t want another chatbot. They don’t want another “AI-powered” feature bolted onto a legacy CRM.

They want a partner. They want a platform that can act — not just talk.

OpenAI calls this the “capability overhang“ — the growing gap between what AI models and agents can do and what enterprise organizations can actually absorb.

Frontier is OpenAI’s answer. It’s not just a tool. It’s infrastructure.

The First Movers

OpenAI didn’t launch Frontier into a vacuum. They secured six “first mover” customers before the announcement even went live:

- HP

- Intuit

- Oracle

- State Farm

- Thermo Fisher

- Uber

And early development efforts drew on work with BBVA, Cisco, and T-Mobile.

Let’s pause here.

Oracle is on that list. Oracle, the legacy database giant that has spent the last decade trying to become an enterprise cloud platform. Why would they partner with OpenAI?

Because they know they can’t win the agent war alone.

Oracle’s database is a system of record. Frontier is a system of action. And in the age of agentic AI, action beats record-keeping every time.

The Salesforce Problem

Salesforce has arguably the best-known agent management product on the market: Agentforce.

Launched with much fanfare, Agentforce was supposed to be Salesforce’s answer to the agent revolution. It lets companies build AI agents that can handle customer service tickets, qualify leads, and automate routine CRM tasks.

But there’s a catch.

Agentforce only works inside the Salesforce ecosystem. It can’t orchestrate workflows across Workday, Oracle, SAP, and Microsoft 365 without complex integrations and middleware.

Frontier, by contrast, is platform-agnostic. It’s designed to work with a company’s preexisting infrastructure and AI agents built by third parties.

As TechCrunch reported:

“Frontier users can program AI agents to connect to external data and applications, which allows them to execute tasks far outside of the OpenAI platform.”

That’s the killer feature. Interoperability.

Salesforce wants you to live in their walled garden. OpenAI wants to give you the keys to the entire kingdom.

The “Forward-Deployed Engineer” Strategy

Here’s where things get really interesting.

Frontier isn’t just a self-serve platform. OpenAI is deploying forward-deployed engineers — engineers employed by OpenAI but embedded within customer organizations — to help integrate Frontier with existing corporate systems.

This is a page straight out of the Palantir playbook.

Palantir built a $40 billion company by embedding engineers with government and enterprise customers, helping them deploy Gotham and Foundry in complex, legacy-heavy environments.

Now OpenAI is doing the same thing for AI agents.

This isn’t a land-and-expand motion. It’s a land-and-dominate motion. Once OpenAI engineers are inside your infrastructure, integrating Frontier with your core systems, switching costs become astronomical.

The SaaS Apocalypse (Not)

When news of Frontier broke, the market reacted violently.

Investors immediately recognized the threat. If OpenAI can orchestrate workflows across Salesforce, Workday, and Oracle, why do you need the native automation tools those vendors are selling?

Why pay for Salesforce’s “Einstein” AI when Frontier can do the same job — and also talk to your HR system, your ERP, and your Slack instance?

As Fortune put it in their headline:

“OpenAI launches Frontier, an AI agent platform for enterprises to power apps like Salesforce and Workday—but could it eventually replace them?“

That question sent software stocks into a tailspin. An estimated $285 billion was wiped off the market value of software, legal tech, and data-services names in the days following the announcement.

But here’s the thing: The SaaS apocalypse isn’t happening. Not yet.

As Jeremy Kahn noted in Fortune’s “Eye on AI” newsletter (Feb 10):

“AI agents from Anthropic and OpenAI aren’t killing SaaS—but incumbent software players can’t sleep easy.”

The market is swinging wildly between “all good” and “all bad” — what Kahn calls the “paranoid-schizoid position“ in Kleinian psychoanalytic terms.

The reality, as always, is more nuanced.

The Nuance Nobody Is Talking About

Frontier is not a Salesforce killer. Not today.

Here’s why:

Data Gravity: Salesforce isn’t just a CRM. It’s a database of customer relationships built over decades. Migrating that data is a multi-year, billion-dollar undertaking. Nobody is ripping out Salesforce overnight.

Customization Debt: Enterprise Salesforce instances are heavily customized — custom objects, Apex code, Flow automations, integrations. Frontier can orchestrate workflows, but it can’t replicate years of bespoke configuration.

Change Management: Enterprises don’t buy software; they buy outcomes. And outcomes require change management, training, and adoption. Salesforce has an army of admins, consultants, and partners. OpenAI has… forward-deployed engineers.

But here’s the flip side:

Frontier doesn’t need to kill Salesforce to win. It just needs to become the orchestration layer on top.

If Frontier is the brain and Salesforce is just a muscle, who captures the value?

The “System of Action” Thesis

This is the real war: System of Record vs. System of Action.

For the last 20 years, enterprise software has been about systems of record. Salesforce records customer interactions. Workday records employee data. SAP records financial transactions.

Whoever holds the record holds the power.

Agentic AI flips this model. In a world where AI agents execute workflows across systems, the orchestration layer becomes the source of power.

Frontier wants to be that layer.

It doesn’t need to replace your CRM. It just needs to be the thing that decides what your CRM does.

And once it’s making those decisions, capturing the usage data, learning from the outcomes… well, then Salesforce is just a dumb terminal.

The Pricing Question

OpenAI declined to disclose pricing details for Frontier in the press briefing.

But here’s what we know:

- It’s positioned as an “AI cloud subscription“ — suggesting a recurring revenue model.

- It bundles existing OpenAI tools (ChatGPT Enterprise, Business) with agent-building tools (Agents SDK, AgentKit).

- It includes forward-deployed engineering — a high-touch, high-cost service.

Analysts speculate that Frontier could cost millions per year for large enterprises — comparable to a major SaaS contract.

But here’s the kicker: If Frontier can replace even one or two legacy SaaS contracts (say, a $5M Workday deal and a $10M Salesforce expansion), the ROI is immediate.

OpenAI isn’t competing on price. They’re competing on consolidation.

What Happens Next?

Frontier is currently available only to a “limited number of users,” with plans to roll out more generally in the coming months.

Watch for these signals:

Case Studies: OpenAI will publish success stories from HP, Uber, and State Farm. Look for specific metrics — “X% reduction in manual workflows,” “Y% faster time-to-resolution.”

Partner Ecosystem: OpenAI will announce integrations with middleware providers (MuleSoft, Zapier, Workato) and consulting firms (Accenture, Deloitte). This is how they scale beyond the forward-deployed model.

Competitive Response: Expect Salesforce to announce a major Agentforce upgrade — likely with deeper cross-platform integrations and a more aggressive pricing model.

M&A Rumors: Salesforce, Workday, or Oracle might explore acquisitions to bolster their native agent capabilities. (My money is on Salesforce buying an agent orchestration startup.)

The Bottom Line

The war for enterprise AI isn’t about who has the best model. It’s about who controls the workflow.

OpenAI Frontier is a bid to control the workflow across the entire enterprise tech stack.

Salesforce, Workday, Oracle, and SAP can fight back — by opening their platforms, by improving their native agents, by lowering prices.

But they’re fighting the last war. The last war was about features and integrations. This war is about autonomy.

Who gets to decide what your software does?

If OpenAI wins that question, the SaaS incumbents become commodities. And commodities don’t command 10x revenue multiples.

Digital Strategist Briefing:

- P0 Risk: If you’re a Salesforce/Workday admin, start evaluating Frontier now. Don’t wait for the general rollout.

- P1 Monitor: OpenAI’s case studies from first-mover customers (HP, Uber, State Farm).

- P2 Action: Audit your current SaaS stack for “orchestration vulnerability” — workflows that could be abstracted by a platform like Frontier.

This analysis is part of our “Enterprise AI” intelligence cycle. For more deep dives, visit our content factory at https://nibaijing.eu.org.